Malaysia, as one of the internet-native countries of South-East Asia after Singapore, presents huge opportunities for e-commerce, with a USD1.1 billion market by the end of 2017. According to Deloitte in 2010, the multichannel shopper constitutes 80% of the consumer market, and they spend 82% more per transaction than those who only shop in store. But the question is, how exactly is the Malaysian performance on online purchasing? What makes them buy things online? And in which channels should marketers be present?

We asked more than 1,000 Malaysians about their online purchasing behaviours. The objectives of the survey were:

- Find out the Malaysians path-to-purchase involving online or offline shopping

- Identify the channels that provide the first and effective stimuli for purchase in Malaysians

- Uncover the concerns and pain points of Malaysian online shoppers

In this survey, we also provided a Cross-Tabulation report for reference of the result differences between age, demographics, and income level. Participants were requested to fill in the contact form below upon downloading.

Going back to definition.

Before we start, we identified multiple definitions that may aid in your reading of this report:

1. Multichannel Shopper

People who buy the product across different channels, either online or offline. Consumers use multiple channels to browse and purchase products, with the argument that each user journey is different.

2. Multichannel Customer

People who utilise more than one channel in their shopping phases (not only purchase).

3. Channel

A customer contact point or medium in which the firm and the customer interact, excluding one-way communications

4. Touchpoint

All channels through which firms and customers interact, with the inclusion of one way communications

To explain the survey in a more in-depth fashion, we divided the results into four different parts, in which, the first three explains how consumers behave and prefer from awareness, consideration and purchasing stage. The fourth part is recommendation of how brand should react based on our survey findings.

1. Purchase Frequency & Product Category

How often do Malaysians shop online? When was their recent purchase? We found that 90% of the respondents answered their recent online purchases with a rate of 56% within July whilst 34% of them had a purchase between 1 and 3 months ago. This validates the rise of the online purchase scene in Malaysia. In terms of frequency, more than 70% shop at least once online, which shows an increase in the online shopping behaviour from last year in Malaysia.

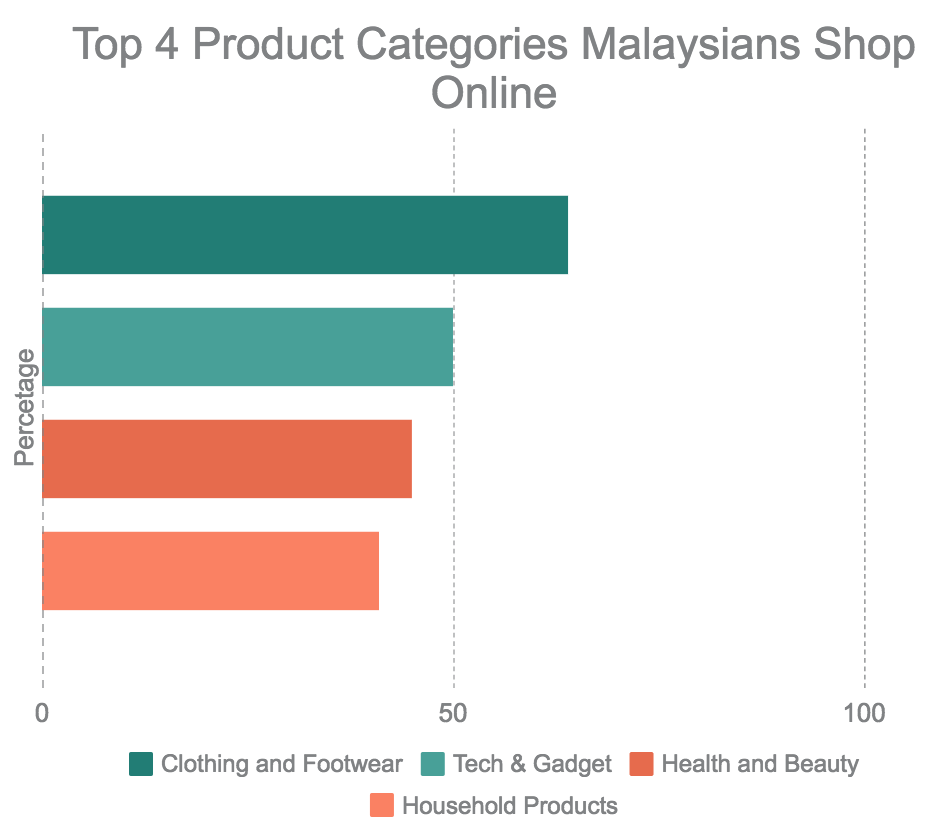

Here is the list of the product categories that respondents have bought online:

We also asked about their favorite product category to buy online. Interestingly enough, Tech, gadget and accessories (18%) are the most favorite product category to be bought online, followed by Health and Beauty products (14%).

2. Influence of Online Presence

The concept and idea of online presence has shifted consumer behaviour in each of the phases of their own customer journey. Nowadays, 90% of consumers expect offline stores to have online websites for their product information browsing option and to purchase directly from. In addition, the rate of people who prefer online shopping is greater (55%) than those who prefer to shop offline (45%). Marketers should leverage their online presence and create seamless path-to-purchase for consumers online.

And in the case of stimuli, what sparked the thought in Malaysians about online shopping?

Stimuli is what gently knocks on the minds of consumers, asking them whether or not they want to buy something. As one of the most social-media savvy in South-East Asia that spend an average of 5 hours on social media, Malaysians get the first stimuli to shop when they surf social media (66%). Nonetheless, direct influence from friends and family are still relevant as 49% agree that their first thought about shopping stems from their close relatives. This shows that online stimuli are much more effective than offline stimuli, such as shopping malls (28%), television (21%), magazines/newspapers (19%).

If online stimuli is much greater than offline stimuli, which channels are the most effective?

Social media and e-commerce websites are both effective online stimuli (both 72%), followed by brand related websites/apps and video websites such as YouTube, Twitch and Vimeo. Again, marketers should consider building a great website to support offline channels now that we know it works as a stimuli (get your SEO and Ad game strong) until purchase.

In consideration Stage, what are the things that proven to influence Malaysian multichannel shopper to shop?

To make it clear and actionable, we divide the explanation of the consideration stage based on the activities performed by actors. In this case, there are only two actors, the consumers and the brand/business

3. Consumers Activities and Content Preferences in Consideration Stage

We found that in the consideration stage, consumers tend to look into online content to convince themselves to buy something, whether it be offline or online purchase. Malaysian multichannel shoppers tends to rely on articles and blogs (56%) as a source for information, followed by infographics (56%) and videos (40%). The type of online information they look for were also found to be product reviews (70%), product comparison with other alternatives (57%) and product launch updates (39%).

What matters the most in website?

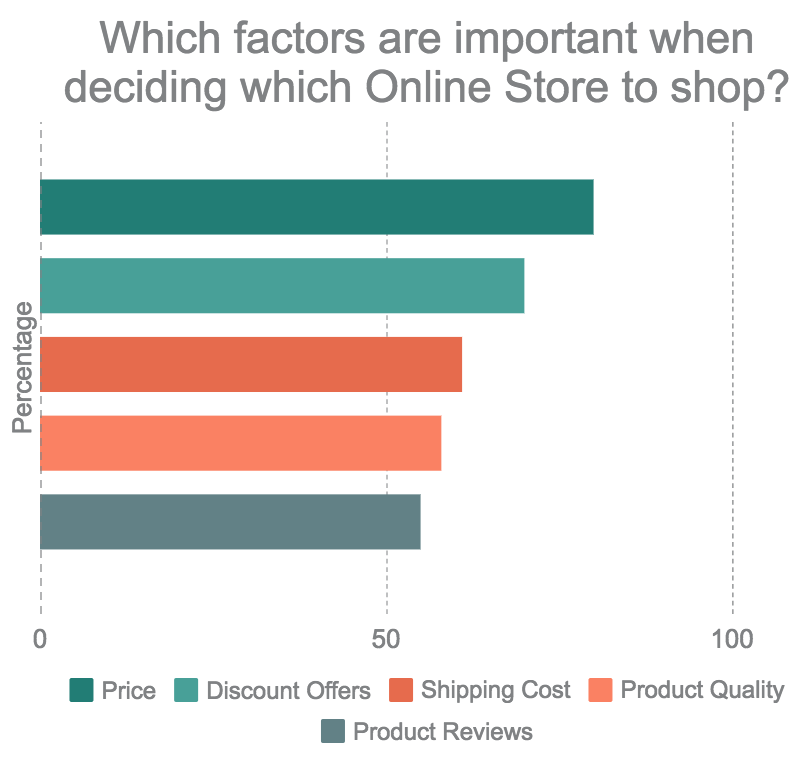

What convinces and pulls them in to buy from your website? We found that the price wins all. 82% agreed that the price is what influences them in their purchase. But afraid not, there are several other things that you can look forward into:

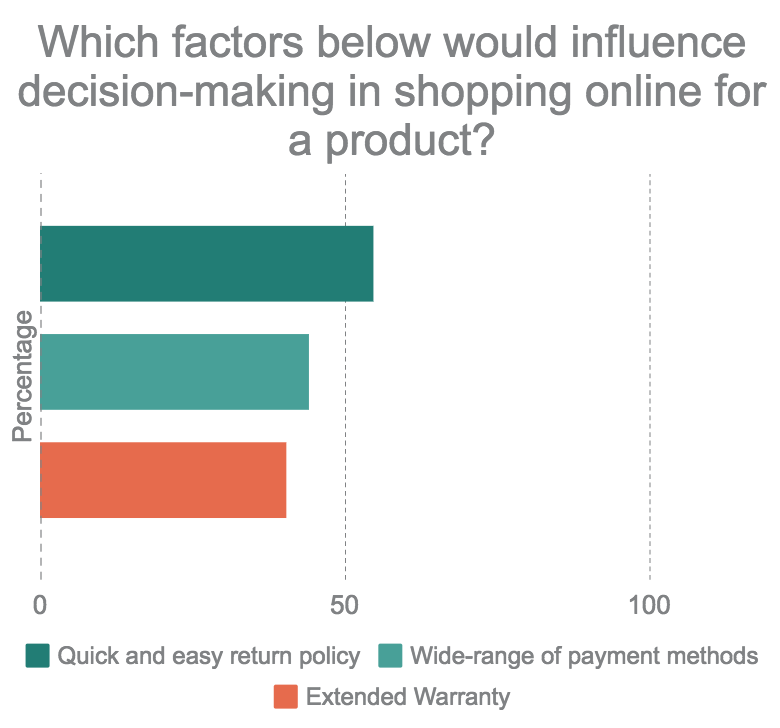

To emphasize your influence towards Malaysian multichannel shoppers, we asked respondents the factors that influence their decision for shopping online:

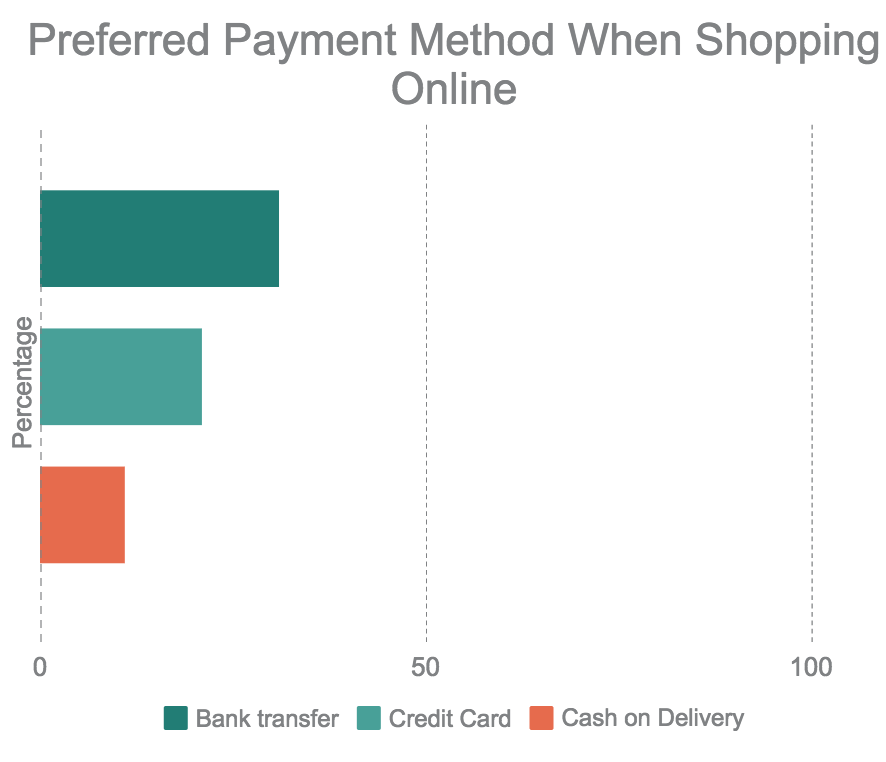

What are their preferred payment method?

Across Malaysia, Bank transfer is the most preferred payment method. Interestingly enough, credit card is the most preferred payment method in Penang (28%), Perlis (40%), Selangor (25%) and WP Kuala Lumpur (34%) other than any payment methods avaliable.

4. Brand/Business activities

In the part, we are trying to find the direct implications for businesses by trying to answer these questions: What kind of things should you do in the consideration stage? and What triggers them to buy things online?

Triggers

Price matters. 77% of shoppers agree that promotions such as discounts like the buy 2 get 1 free concept, influences them to shop. Word-of-mouth still remains as a relevant factor as 47% of them agree that recommendations from close relatives trigger them to buy. However, a rate of 55% agree that they have already identified what product category they want to buy in this stage. Therefore, we can argue that switching to another brand in the same product category will be more likely due to promotions, and recommendations from friends and family.

Pain Points

Businesses exist to help people solve their problems. Here we listed several things that might be a concern for Malaysian consumers in shopping online, the questions are crafted from consumer perspective. Below are several interesting findings about consumers’ pain points in shopping online. These pain points will helps you to improve or to add feature in your online presence:

- Unsure about the product’s authenticity (87%)

- The actual product quality is not as promised (81%)

- Delivery cost too pricey sometimes (80%)

- Suspicious of payment system security (79%)

- Delivery takes too long (75%)

- Uncertainty of the website’s genuineness (73%)

- Limited information about the product on the website (69%)

Conclusion

While there is a lot of room for improvements and adjustments, e-commerce in Malaysia provides huge opportunities for businesses. The rate of multichannel customers or multichannel shoppers are increasing, whereby they utilise online channels in any stage of the purchasing process. Online purchasing is also more diverse, from clothing and footwear, to tech & gadget accessories up until household products.

The stimuli, consideration, purchase and post-purchase phases can all happen online. Therefore businesses should should craft their online presence to be more seamless and ‘believable’, addressing that there are many consumers with concerns in buying online because they are uncertain of the genuinity or that the products offered are not authentic.

While price proves to be a priority, businesses can diversify its unique selling proposition on their website online. Make it more personal, and engaging, because people do not necessarily buy things online. They have the option to browse the product online and buy it in the offline store. Emphasize on important matters and provide the product information in a detailed fashion. The best thing that could happen from having a seamless, detailed information and at the same time providing a unique user-experience, is word-of-mouth - the purest and most convincing form of persuasion.